Advantages of Setting Up an Asset Protection Trust in Nevada

While commonly known as a “domestic asset protection trust” the asset structure used in Nevada is technically a “qualified spendthrift trust”. The name is significant because some of the key characteristics are based on a lifetime, rather than a post-mortem, asset protection strategy. Some of the key benefits of Nevada’s laws that make it the most advantageous jurisdiction for asset protection trusts are among the following:

- Most states tax the income of trusts, but Nevada does not.

- Most states require a three to four-year statute of limitations to establish protection of transferred assets in the trust, but Nevada’s is only two years.

- Only two states offer zero exception creditors, including divorcing spouses, and Nevada is one of them.

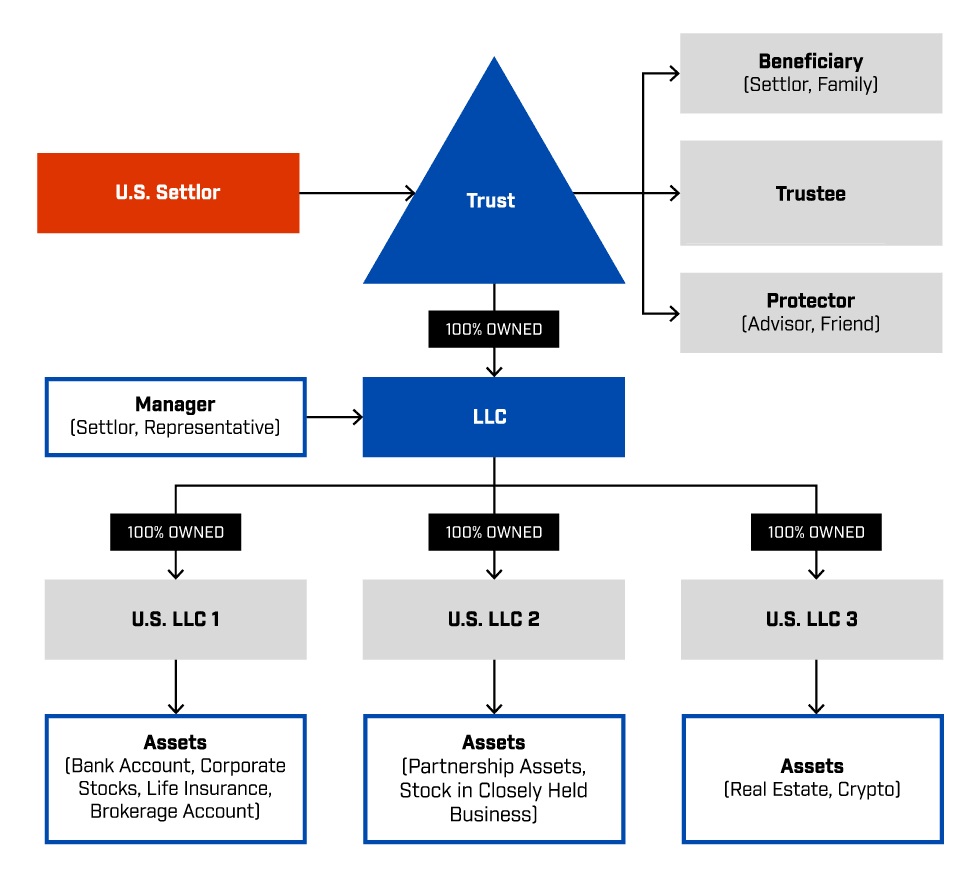

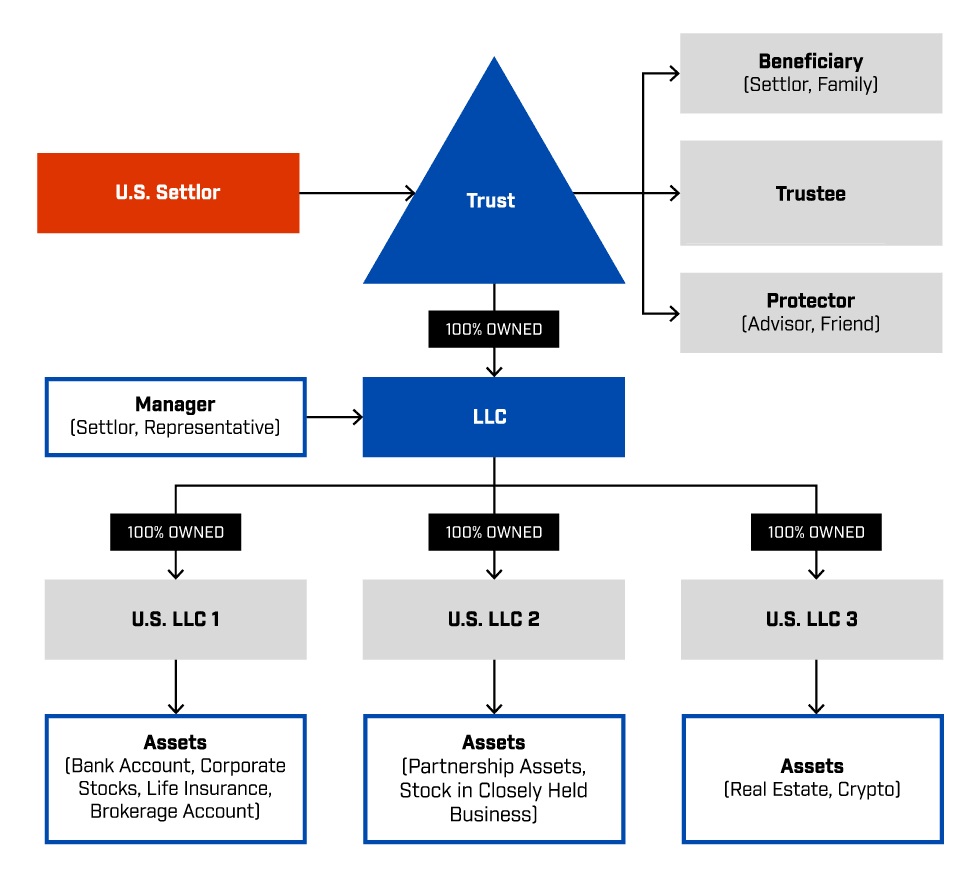

- Nevada allows the grantor, or settlor, to appoint an independent financial advisor to manage the assets in the trust, which is also known as a directed trust.

- Nevada has no rules against perpetuities, meaning the state allows for perpetual, or dynasty, trusts. The state allows the creation of a trust that continues for up to 365 years, thereby minimizing the transfer taxes that may otherwise be assessed.

- Nevada also offers one of the best decanting statutes, providing an effective means to accommodate changing family needs and dealing with outdated trust provisions.

- The trust no-contest clause afforded in Nevada helps to eliminate challenges to trust provisions and beneficiaries.

- Nevada offers some of the most flexible and protective limited liability and limited partnership laws.

- Nevada’s trust laws provide the highest level of confidentially to settlors and trust beneficiaries.

- The Nevada legislature is continually working to improve the trust laws of the state to be a more welcoming and effective asset protection strategy.

- Anyone, even international families, and businesses, can set up an asset protection trust in the state of Nevada. The only requirement is that the trustee or co-trustee resides in Nevada

- Nevada is cryptocurrency-friendly state.

A carefully prepared NAPT can be used to transfer unlimited assets outside of a potential creditor’s reach, gift-tax free, or can be used to move assets completely outside of the Grantor’s estate and enjoy asset protection in addition to estate tax minimization.

Which assets can be protected in a Nevada Asset Protection Trust?

Nevada asset protection trusts may be used to protect any type of assets:

- Cash and/or cash equivalents

- Personal property

- Real estate;

- Stocks and bonds;

- Investment accounts and proceeds;

- Closely held business interests, such as membership interest in an LLC or shares in a private corporation.

Types of Trustees in a Nevada Asset Protection Trust

A typical Nevada Asset Protection Trust has three trustees. Under Nevada Law, at least one of the trustees must be a resident of Nevada like a trust company with an office in Nevada. Each trustee has distinct roles and responsibilities in the trust document:

Investment Trustee – Determines what the trust buys, sells, and holds.

Distribution Trustee – Determines when an asset leaves the trust and is distributed to a beneficiary.

Administrative Trustee – Maintains the books and records of the trust and signs tax returns.

Nevada law allows you as the grantor to serve as your own investment trustee to make investment decision on behalf of a trust. The exception is that a grantor cannot make distribution decisions.

How to Set-up NAPT?

Although no specific language is required to create a valid spendthrift trust, so long as the creator’s intent is clear, a spendthrift trust must be in writing and clearly identify the beneficiaries in that writing.

Here is what one can expect from a qualified spendthrift trust when it is established in the state of Nevada:

- The creator, or settlor, of the trust, can also be the sole beneficiary

- The settlor retains control and authority over the investments in the trust, as an “investment advisor” and may veto decisions made by the person responsible for managing its assets, known as the trustee.

These two characteristics are essential when forming an asset protection trust because it would not be an effective means of asset protection if the settlor could not control the trust’s investments or receive distributions.

Another important aspect of a NAPT is its ability to insulate the trust’s assets from creditors. The Nevada domestic asset protection trust is among the most effective in this area, provided it has been properly set up and the assets in need of protection have been contributed in a timely manner.

When structured properly a NAPT is able to provide the flexibility and protection required to safeguard an individual’s wealth during his or her lifetime, while allowing them necessary access to the assets and income held in the trust.

Our experienced team of asset protection lawyers at the Dilendorf Law Firm help clients to determine the best ways to safeguard assets while maintaining the most flexibility over assets and income. To learn more about Nevada Asset Protection Tursts and the other options that are available, we encourage you to schedule a confidential initial consultation.

Resources: