Helping Clients Navigate Through MTL Requirements and Challenges

With limited exceptions, any business that accepts and transmits funds, including cryptocurrencies, such as bitcoin, will be considered an MSB and require an MTL in each U.S. state where the business operates.

Money transmitters are a part of a broader category of MSBs. So, the terms MTL and MSB are related and often used together.

While registration on the federal level is relatively straightforward, the MSB legislation is not harmonized and almost all 53 states and territories have their own regulations, requirements and exceptions for money transmitter licensure.

In addition, New York established a separate license for digital currency businesses, the so-called “BitLicense” – a license required to engage in any “virtual currency business activity”.

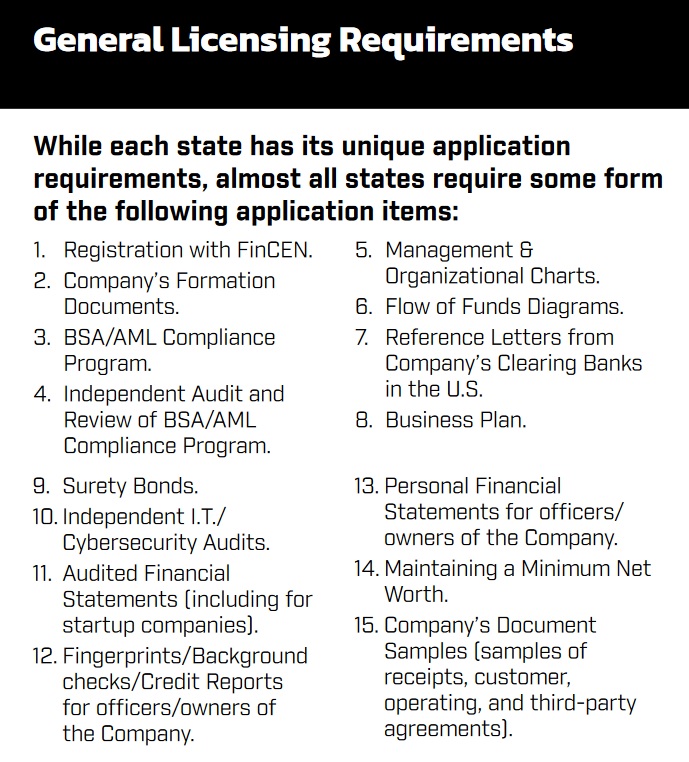

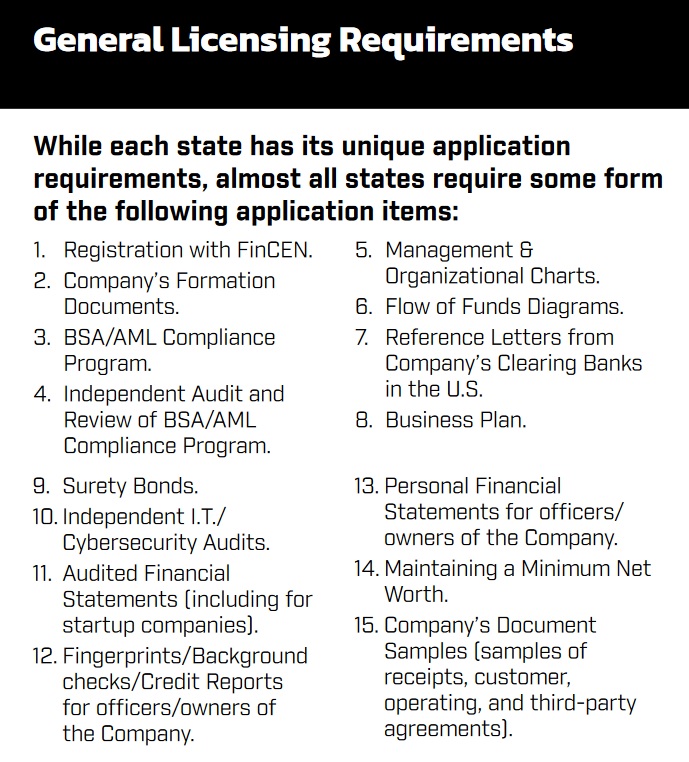

MTL requirements vary state-by-state but usually include registration with the Financial Crimes Enforcement Network (FinCEN), background checks, application fees, security (surety bond), maintenance of permissible investments, minimum net worth, business plan and a compliance program.

MTL-related costs and processing times may differ significantly from state to state, especially compared to New York and California.

Because of the lack of consistent regulation, companies tackling the U.S. MSB market must develop a comprehensive strategy to get MTLs.

When obtaining MTLs, a business may choose to prioritize some states and apply first there but will be prohibited from operating in the states where it does not maintain an MTL.

Guiding Clients Through MTL Application Procedures in Every State

Our lawyers advise and assist clients throughout the MTL application process, including the following steps:

- Developing an MTL strategy nation-wide for traditional businesses and cryptocurrency trading platforms and exchanges;

- Selecting and establishing optimal corporate and tax business structures supporting US and cross-border payments and remittances;

- Preparing a business plan, summary of historical and current operations, financial statements, affidavits and other required documentation;

- Submitting applications in individual states;

- Acquiring mandatory surety bonds;

- Completing FinCEN registration;

- Accomplishing necessary corporate actions, including local qualification of out-of-state companies, provision of registered agents, drafting/amending corporate governance documents;

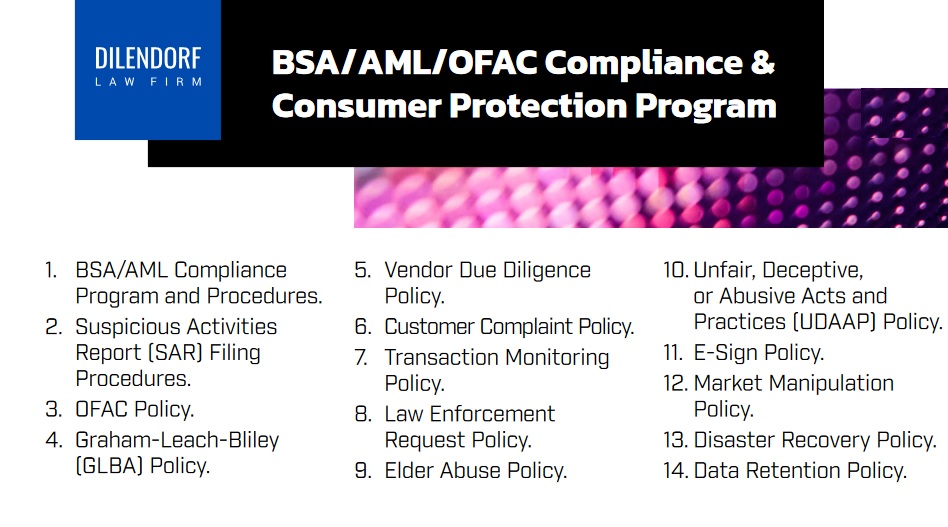

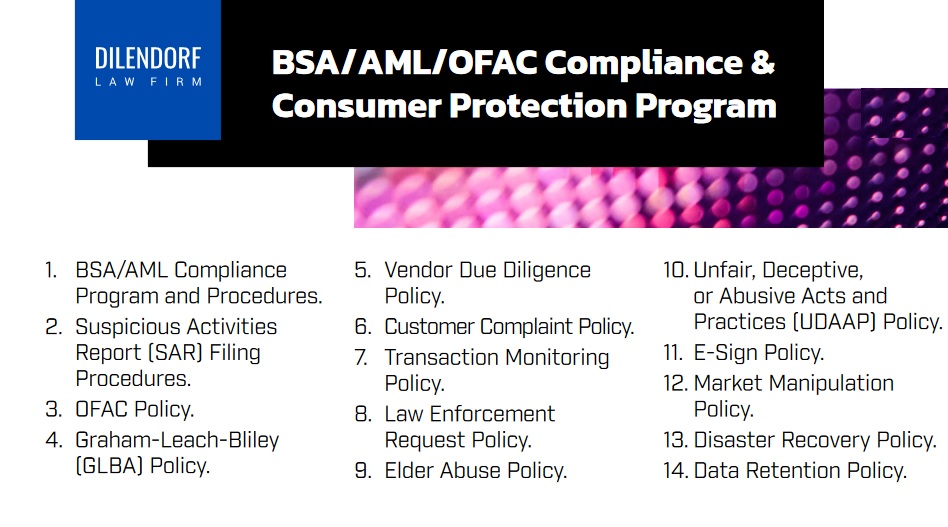

- Developing anti-money-laundering (AML) and other compliance programs;

- Representing clients in communications with the federal and state agencies; and

- Maintaining and renewing MTLs.

Stablecloin TRUST Act of 2022

Stablecoins are digital assets that are designed to maintain a stable value relative to a national currency or other reference assets. Stablecoins have experienced tremendous growth in the past year, serving as a possible breakthrough innovation in the future of payments.

A dollar-pegged stablecoins backed by adequately safe and liquid collateral can potentially serve as a digital safe haven currency during periods of crypto market distress.

The Stablecoin Trust Act requires a stablecoin issuer to hold all reserves associated with each fiat currency-backed stablecoin they issue in (1) certain government securities; (2) fully collateralized security repurchase agreements, or (3) U.S. dollars or other nondigital currency.

Further, the Act provides that payment stablecoin issuers must choose from one of three regulatory regimes:

- A state-based money transmitter or similar license under state law;

- A traditional bank charter; or

- A new federal license designed specifically for payment stablecoin issuers.

The state-based MTL route is the most economical option.

A fiat currency-backed stablecoin is a digital asset backed by a nondigital currency and is redeemable on a one-to-one basis in that currency. Under the proposed Act, each stablecoin issuer must publish monthly on their website a report on the reserves held by the issuer that has been audited by a third party.

Contact Us

Please do not hesitate our digital asset lawyers at (212) 457-9797 or via email info@dilendorf.com to schedule a consultation, discuss your legal needs, and explore how we can advocate for your rights and interests.

Read Our Guide on MTL Licenses for FinTech, Web3 and Payment Platforms

Resources:

Federal

Stablecoins Federal Guidelines

New York

California

Florida