Cryptocurrency Asset Protection Strategies for US Residents

Bitcoin, Ethereum, and other cryptocurrencies have generated enormous wealth among many investors, often catapulting them into the stratosphere of the “ultra-wealthy” overnight. As digital currency investors take steps to protect these nontraditional assets, a string of innovative wealth management structures has been born.

High net worth individuals are increasingly diversifying their portfolios to include a variety of cryptocurrencies. As the number of digital asset holders increases, asset protection strategies are adapting to fit their changing needs.

Contrary to what many people believe, the best way to protect a windfall of cryptocurrency assets is by setting up an offshore trust. Among the most impenetrable wealth protection strategies, an offshore trust has far more provisions to prevent creditors from seizing assets in a legal claim, and they are fully compliant with DOJ and IRS regulations, including the Foreign Account Tax Compliance Act (FATCA).

Anyone who has accumulated wealth in any form, especially high-risk professionals, and business owners, may wish to protect these assets from potential liability. With so many different asset protection strategies available to US citizens, selecting the right structure and jurisdiction can be intimidating.

Why Asset Protection is Important for Cryptocurrency

One of the common myths about blockchain and cryptocurrency is anonymity. Early on, the belief that Bitcoin transactions were anonymous and untraceable was a common reason why certain investors used them.

In fact, cash is far more private than virtual currencies. The blockchain allows one to trace all transactions involving a given bitcoin address, all the way back to their first transaction.

One commonly held misconception is that crypto assets are difficult to trace and thereby have intrinsic protection from creditors. In terms of traceability, some federal prosecutors investigating financial crimes have compared Bitcoin wallets to conventional bank accounts. This means virtual assets will still need to be included in any asset protection trust.

If a crypto investor is sued or goes into debt, the courts can force the disclosure of all relevant information about the currency and property a defendant owns, and that includes digital assets.

Needless to say, cryptocurrency must be a part of any asset protection strategy. Crypto wallets can be traced to crypto exchanges and crypto exchanges can be subpoenaed to reveal account ownership information and the amount of available funds deposited on the subpoenaed wallet account. Thus, digital assets are just as vulnerable to seizure by private creditors as anything else a defendant owns. The only way to fully protect cryptocurrency assets is through a trust.

Domestic or Offshore Trusts?

The determination of whether to use a domestic or offshore asset protection trust will depend on many factors, but the possession of cryptocurrency may complicate this decision. In order to make the best choice it is helpful to learn about the unique qualities and limitations of each strategy.

Before developing an asset protection strategy for any type of asset, it is important to understand that not every asset will be protected from legal actions against the settlor. One of the more widely accepted methods of protecting wealth from liability risk has been the state based Domestic Asset Protection Trust (DAPT).

While many U.S. citizens believe the Domestic Asset Protection Trust (DAPT) is the best option to protect assets from legal claims, these trusts are certainly not bulletproof. U.S. laws are designed to protect creditors, so any trust based in the United States can be vulnerable in certain legal situations.

What Kind of Asset Protection is Offered by DAPTs?

Nevada is the most favored jurisdiction because it has no creditor exemptions, but it still has a two-year waiting period before trust assets are fully protected. Similarly, South Dakota has a two-year statute of limitations, but it does have many creditor exemptions.

Other states, such as Delaware and Alaska, have four-year statutes of limitations, and a number of exemptions for certain types of creditors.

Conversely, the Cook Islands statute of limitations is one year from the date the trust is funded.

Ten states that do not offer DAPTs offer similar provisions within an irrevocable grantor trust.

The disadvantages of DAPTs over offshore trusts are as follows:

- If the settlor files for bankruptcy or is forced into it by his or her creditors, their assets must have been in the trust for ten years in order to be protected.

- Judges in the U.S. have been known to order trust assets to be confiscated, regardless of trust provisions and prevailing law.

- Case law surrounding legal liability has trended toward providing the greatest financial advantage to the legal professionals, instead of trying to shield one’s assets from them.

- Despite what their promoters would have one believe, domestic trusts do not work out as well for settlors who reside in states that do not currently offer them.

- Unlike offshore trusts, the trustee in a DAPT must abide by the laws of the jurisdiction and obey the domestic judge, or risk being held in contempt of court. Such a threat would not work in a foreign jurisdiction.

Traditional Asset Protection Plans are Insufficient for Crypto Wallets

The DAPT is a self-settled trust that allows the settlor protection from future creditors and assures that wealth can be safeguarded for future generations. However, while a DAPT allows settlors to protect their own assets, certain creditors may still be able to access the funds. A court’s discretion could also prevent the case from being tried in the trust’s jurisdiction.

Many crypto investors consider their digital assets to be protected due to the cryptic and deregulated nature of the currency, but this is a false sense of security. When certain assets are excluded from a trust, it leaves individuals vulnerable to legal claims and possible seizure of trust assets, including digital assets. There is a reliable way to protect these assets securely, but it requires a combination of offshore trust and banking laws.

Before we cover the details about the best way to protect digital assets, it is important to understand how the US government views cryptocurrency.

The IRS Treats Cryptocurrency as Property

The IRS views cryptocurrencies as property, not currency. This is an important distinction, because the U.S. dollar-denominated basis is established when the asset is acquired, and the gain or loss may not be realized until the disposal of the asset. This could occur when the asset is converted back to U.S. dollars, or into another cryptocurrency.

Not surprisingly, many people have tried to find ways around paying taxes on their Bitcoin holdings, but it is highly unlikely that the IRS will change its stance on cryptocurrency. As such, any US citizen will need to pay taxes on their digital assets and investments.

Cryptocurrency Trusts and Tax Liability

In terms of asset protection, a cryptocurrency trust can be similar to other trusts, except it exists solely to hold digital assets. While still subject to taxation, a few methods may help to reduce or negate tax liability, but any fraudulent use of these methods is not recommended.

The transfer of Bitcoin or other digital currencies into a living trust is not taxable, as the living trust is not considered a separate taxpayer. A non-grantor trust is another solution because the transferor is not taxed, but the trust does pay taxes and trust distributions could be separately taxed. Attempting to avoid taxes of any kind, even legally, is especially risky for cryptocurrency investors and may not be worth the effort.

Traditional Methods of Cryptocurrency Custody and Security

The high-risk/high-reward aspects of investing in intangible digital assets, such as Bitcoin and Ethereum, make them attractive to many individuals. However, their rapid acceptance as an investment vehicle has led to misinformation about how best to transfer these assets. While illiquid and volatile digital currencies can be exciting for the investor; they can also make asset protection more complex.

On July 22, 2020, the U.S. Office of the Comptroller of the Currency (OCC) published an interpretive letter authorizing national banks and federal savings associations regulated by the agency to custody digital assets (inclusive of cryptocurrencies, digital currencies, or virtual currencies) on behalf of their clients. This development should give prospective trustees and financial service providers confidence when asked to provide custody for cryptocurrencies.

While cryptocurrencies have no central or regulating authority, they are managed by a decentralized system. This fully computerized approach relies on cryptography to prevent fraud, but instead of using outdated methods of cryptography, information about the assets held in investors’ “hot wallets” is encoded by computers. Passwords for decoding and accessing these assets are held in a “cold wallet, which is a hardware device not connected to the internet.

As a result of the encryption used to secure digital assets, any cryptocurrency held in a trust must include access to the keys that will open the wallets. When the keys are inaccessible, so are the digital assets.

In addition to the security, storage and accessibility of digital assets, crypto investors in should also consider how a trust impacts of price volatility, taxation, valuation, and illiquidity.

Provisions in a Trust for Crypto Assets

Anyone considering taking on fiduciary responsibility for crypto assets will need to be very careful about how access to these wallets is administered. Once someone else has access to the key, that person can access the wallet without the owner’s permission or knowledge. Balancing that risk against the risk of beneficiaries being locked out can be tricky, but there are ways to safeguard the keys while make the settlor’s wishes known to a trustee.

Volatility among cryptocurrencies could present risks for trustees, especially in the event of a market crash where the trust could suffer significant losses. It is therefore critical to have clear guidelines in place to mitigate losses to the trust fund. Custom drafting is likely to be required in this regard.

Why are Offshore Trusts the Best Option for Protecting Digital Assets?

Seeking out the strongest asset protection vehicle for digital assets can be a complex task for the average investor. A common misperception about offshore trusts is that they are a method of “hiding” assets from the scrutiny of the federal government or avoiding the IRS, but that is simply untrue.

For the same reasons that one would consider using an offshore trust for other assets, such as cash, stocks, and real property; anyone seeking protection from legal claims should consider an offshore trust. More specifically, a Cook Islands trust offers the most impenetrable protection for high-risk professionals and business owners.

In fact, offshore trusts must follow the United States Department of Justice Offshore Compliance Initiative, which enforces compliance with required disclosures and tax laws for U.S. investors.

Why a Cook Islands Trust?

While many offshore jurisdictions are recommended for asset protection, most will have certain drawbacks that make them less attractive. Some countries, such as Switzerland, the British Virgin Islands, and the Cayman Islands are known by the rich as tax havens, where income can be sheltered from the IRS. But the Cook Islands, a self-governing state associated with New Zealand, offer a different type of protection – the long arm of the law in the US simply does not reach it.

Known for their general disregard for foreign court orders, the Cook Islands trust is known for keeping assets out of the reach of creditors, or anyone else seeking to file a legal claim. This unparalleled security is only matched by the level of privacy and anonymity not found in other offshore jurisdictions. It is where wealthy individuals hide their hard-earned assets from the grasp of former spouses, angry business partners, or litigious patients.

These stories, which were documented by the New York Times, cite examples of how U.S. courts were unable to dismantle Cook Islands trusts:

- Nadya Suleman, who became known as the Octomom after giving birth to octuplets in 2009, sued the doctor who implanted the embryos in her. However, Dr. Kamraya’s assets were in a Cook Islands trust and therefore difficult to recover.

- The Federal Trade Commission (FTC) has also come up dry, in an attempt to collect a $37.5 million judgment against Kevin Trudeau, author of The Weight Loss Cure, for “airing blatantly deceptive infomercials.”

- Even the United States government has had a hard time going up against a Cook trust. Fannie Mae, a government-sponsored lender, was unable to collect on a $10 million judgment against Oklahoma real estate investor Andrew Grossman, despite a trial that dragged on for years.

When even the United States government has been unable to breach this type of trust, it is fair to say that it offers the best protection for high-risk individuals. Undoubtedly, public opinion about offshore funds has prevented some individuals from pursuing this option, but rest assured there is nothing illegal about establishing a Cook Islands trust.

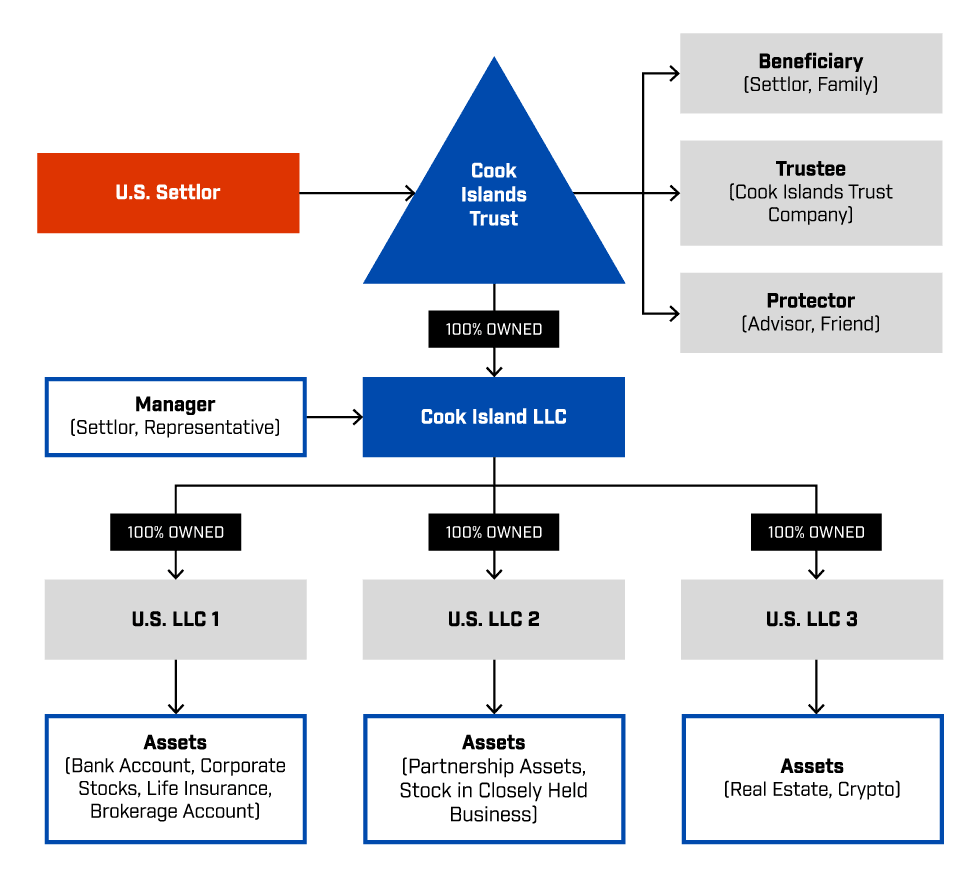

Structure

A typical Cook Islands Wealth Protection structure has several components allowing both flexibility and protection:

- The Settlor establishes a Cook Islands International Trust

- A Cook Islands licenced trustee serves as the Trustee

- The flexible Trust structured allows the settlor and his family members to be appointed discretionary beneficiaries of the Trust

- Protector can be appointed to monitor the activities of the Trustee, and can be granted absolute or veto powers or a combination of both

- The Settlor can provide a letter to the Trustee detailing his/her wishes in regards to the investment and distribution of assets both during and after his/her lifetime

- The Trust owns 100% of a limited liability company (“LLC”) incorporated in the Cook Islands, or other jurisdiction appropriate to the client’s circumstances

- The Settlor, or his representative, is the Manager of the LLC

- Assets are held and managed within the LLC or entities underlying it

Cook Islands Are Crypto-Friendly

Cook Islands Ministry of Finance and Economic Management (MFEM) recently modernized the trust industry by launching ‘Smart Trust platform’ built on a blockchain. This moved the traditional legal framework and processes onto a blockchain-based digital platform.

This program enables creation of Crypto Smart Asset Protection Trusts, which allows clients to manage their crypto assets and NFTs in a safe and trusted environment.

Crypto Smart Asset Protection Trusts built on the blockchain:

- ensures privacy;

- allows management and trading of cryptocurrencies inside placed inside of a trust;

- ensures transparency between desired individuals (e.g., trust beneficiaries) but not available to the world at large;

- allows transfer of digital asset ownership (e.g., Bitcoin, Ethereum, NFTs) to the trust from any third party;

- allows transfer of asset’s ownership out of the trust.

The use of Crypto Smart Asset Protection Trusts allows asset protection planners and clients access protection without the inherent problems and risks of traditional trusts. Smart Trusts efficiently combined the benefits of the traditional trust with blockchain technology, transcending limitations that existed in the ownership, management and administration of both cryptocurrency and physical assets.

Why do Cook Islands Trusts Exist?

Americans have parked more than $1 trillion in offshore accounts around the globe, and while the US government has tried to regulate it, the Cook Islands trust seems to be relatively immune to US scrutiny. Cooks Trusts are widely used by multinational companies to seek out optimal tax advantages, but they have not been linked to money laundering or terrorist financing; As a result, they have garnered very little attention from foreign regulators.

Why is a Cook Islands Trust Attractive to High-Risk Professionals?

Our litigious society puts high-risk professionals in a precarious position, and they want protection that can be relied upon. The Cook Islands trust laws eliminate some of the less desirable aspects of US asset protection trusts while providing a more robust set of advantages that favor the settlor.

Interestingly, these trusts may only be held by foreigners, with the islands’ external marketing campaigns aimed at “discerning wealthy clients” primarily in the United States.

As the Cook Islands Trust became more ubiquitous and increasingly popular with American businesses, they have maintained a great reputation for security, and that now extends to the custody of cryptocurrency. Anyone looking for the most powerful asset protection benefits, particularly those who are worried about future litigation, should seriously consider this option.

Aside from digital asset protection, here are some of the most compelling reasons to consider a Cook Islands trust:

- All business related to a Cook Islands Trust may be handled electronically, with no need to travel to the islands.

- The laws surrounding Cook Islands trusts were written with Americans in mind and were actually written by a Colorado asset protection attorney.

- Cash and investment accounts, as well as real estate holdings, digital assets and businesses, may be registered in the trusts, but the assets are not required to be located in the Cooks.

The best candidates for a Cook Islands trust are any high-risk professional with assets exceeding $1 million. These include doctors, attorneys, architects, financial advisors, real estate developers, fintech entrepreneurs, and corporate executives, among others.

A creditor who wishes to extract assets from a Cook Islands trust must re-try the case in the island nation where it was formed, in a jurisdiction known for its unfriendliness to creditors.

In addition, the plaintiffs are required to pay legal fees and court costs upfront. It is also likely that the loser of the case will pay their own legal fees as well as the winner’s.

How Does an Offshore Trust Operate?

Once the Settlor works with his or her attorney to create the Deed of Trust, the attorney files the deed and a Trustee is appointed to manage the assets, which are subsequently transferred to the trust.

It is important to note that, once the settlor places assets in the trust, the Trustee receives the title to those assets, meaning they are no longer owned by the settlor. The trustee has actually acquired ownership to the Deed of Trust but must manage them according to the legal agreement with the settlor.

This step is the key to effective asset protection through a trust: No court can seize what the defendant does not legally own.

When someone attempts to seize these assets, not only will they no longer be available because those assets have been transferred to a trustee that resides outside of the judicial system of the settlor’s home country. This is important, because it means that the trustee is not subject to the home country’s legal claims. Instead, they will be bound by a different set of laws, which will favor the protection of the trust assets.

The same courts that wield influence and power at home will not have the authority to compel a trustee to turn over the assets in the trust. The only issue that might impact certain assets if the timing of the transfer, which may be deemed as a “fraudulent transfer” in certain circumstances.

Fraudulent Transfer

As with all matters in asset protection, there is always a risk of engaging in fraudulent transfer. A fraudulent transfer occurs when a settlor deliberately moves assets out of his or her possession in order to become insolvent in the eyes of a court.

What constitutes a fraudulent transfer? That depends on the timing. The later the transfer, the greater is the risk of it being found fraudulent.

This is a challenge that everyone faces when trying to protect their assets, but digital assets can actually be somewhat helpful in this regard. Because every crypto transaction has a timestamp, this can provide indisputable evidence that the asset was moved at a specific time, which would prove that the transfer was not fraudulent. This underscores the importance of planning now, to be sure these assets are protected long before a creditor seeks them out.

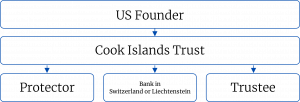

Why a Cook Islands Trust is Best for Digital Assets

Just like the Cook Islands Trust is the answer for those seeking bulletproof asset protection, US investors must consider them as the solution for digital assets. US founders, or settlors, include their digital assets in a Cook Islands Trust, which assigns these assets to licensed financial institutions on the Cook Islands to serve as both the protector and trustee.

Similar to how an individual or business would have a bank account, these trusts also have accounts that safeguard certain assets better than others. In the case of a Cook Islands Trust, digital assets are typically kept in bank accounts located in Liechtenstein or Switzerland, which are reportable in the US in accordance with IRS and Treasury Department guidelines. Under FATCA, certain US taxpayers holding financial assets outside the United States must report those assets to the IRS.

The allure of a Cook Islands trust, in concert with a Liechtenstein or Swiss bank account for crypto custody, is its excellent offshore jurisdiction and reputable banking system. Holding crypto assets in such an account is not about hiding assets from the U.S. government; it is about protecting assets from creditors.

All of the assets in a Cook Islands trust will be reported to taxing authorities, in full compliance with the Offshore Compliance Initiative of the U.S. Department of Justice.

Structure of Cryptocurrency Custody Within a Cook Islands Trust

Here is how the Cook Islands handles digital assets, as part of an asset protection trust.

The trust owns a bank account with custody of the digital assets. This will either be a Swiss bank or a Liechtenstein bank.

How Does a US Founder Protect Digital Assets Within a Cook Islands Trust?

Since these trusts are irrevocable, it is imperative that U.S. founders make their wishes known to the trustee, and that these wishes be incorporated within the provisions of the trust. These wishes should include specific information regarding the preferred handling of digital assets, including investments, trading, staking, etc.

Given the intangible nature of cryptocurrencies, the most challenging aspect for trustees is ensuring the safe custody of private keys in a manner acceptable to settlors. This is not an insurmountable problem, as there are providers in the Cook Islands who can safely administer digital assets, as well as banks in Switzerland and Liechtenstein, which will store private keys in their vault for an annual fee. This is something many trustees prefer over providing custody in-house. As an alternative which avoids the issues associated with custody, a trust could own shares in a cryptocurrency vehicle.

The Bottom Line

The acquisition of cryptocurrencies can be a strategic move in diversifying an investment portfolio. However, relying on the secrecy endemic to crypto is not a safe strategy for protecting these assets.

In regard to protecting assets from legal claims, crypto is no different from many other asset protection-related matters. An offshore trust in the Cook Islands will not only protect traditional assets; connecting it with Swiss and Liechtenstein bank accounts makes this solution ideal for digital assets as well.

Remember, the strongest asset protection plans have multiple levels, interlocking with one another to provide the most airtight protection possible, and are updated regularly to keep up with changing regulations and tax laws.

Resources:

- What You Should Know About Asset Protection Trusts

- Fresh Look at State Asset Protection Trust Statutes

- Offshore Asset Protection Trust: Prudent Planning Device or the Last Refuge of a Scoundrel?

- The Estate and Gift Tax Implications of Self-Settled Domestic Asset Protection Trusts: Can You Really Have Your Cake and Eat it Too?

- Spendthrift and Discretionary Trusts

- Irrevocable Asset Protection Trust

- US Senate Report | Tax Haven Abuses: The Enablers, The Tools and Secrecy

- Domestic Asset Protection Trusts: Debtor’s Friend and Creditor’s Foe

- Asset Protection Trust – Cornell Law School

- Developing Trust in the Self-Settled Spendthrift Trust

- Abusive Trust Tax Evasion Schemes – Questions and Answers – IRS

- Abusive Trust Tax Evasion Schemes – Facts (Section II) – IRS

- Trusts: Common Law and IRC 501(c)(3) and 4947 – IRS

- Domestic Asset Protection Trusts – Brooklyn Journal of Corporate, Financial & Commercial Law

- A Fresh Look at State Asset Protection Trust Statutes – Columbia Law School

- Domestic Asset Protection Trust Alternatives Impact Traditional Estate and Gift Tax Planning Considerations

- Digital Assets and Intestacy

Cooks Islands Trust Resources:

- Cooks Island International Trust Act

- Cook Islands Asset Protection Law

- Asset Protection Trusts

- NYT Article: the Cook Islands, a Paradise of Untouchable Assets

- Behind the Corporate Veil: US Tax Court

- Protection Assets from Creditors Legally, Ethically, and Morally

- Offshore Asset Protection Trust: Prudent Financial Planning Device

- Foreign Trusts

- US Position on Offshore Tax Havens

- Guide to Law Online: Cook Islands Trusts

- Give the People What They Want? The Onshoring of the Offshore

- Use of Trusts and LLCs in Asset Protection

- International Trust and Estate Planning: Asset Protection Trusts

- US Senate Committee on the Judiciary: Fighting Financial Networks Through Transparency

- Cooks Island – International Monterey Fund

- What’s is the U.S. Position on Offshore Tax Havens?

- Asset Protection Trusts – Foreign Asset Protection Trusts